Death by a thousand subscriptions

Reading time: 8 minutes

Topic: Product, pricing

Tl;dr

SaaS has dominated software for 30 years, growing to a projected $1.5T industry by 2025. However, its ubiquity is causing challenges:

Subscription fatigue: The average American has 12 paid subscriptions, totaling ~$350 a month

Slowing growth of new SaaS companies due to market saturation

Rising costs for AI-powered SaaS products due to token-based pricing

The future may see a shift towards hybrid usage-based pricing models. This evolution aims to provide more value and flexibility to increasingly selective consumers while helping businesses manage costs and maintain profitability.

Introduction

Software-as-a-service was first introduced in the 1990s and progressively became more widely adopted over the last 30 years. In fact, it’s set to grow to $1.5T by 2025. However, its own growth might lead to its demise.

Let’s start with defining it is. Software-as-a service can be defined by two elements:

The product is delivered through the cloud

The business model is typically a subscription

During the 1990s, companies started leveraging the internet to get software out to users through the cloud. It was a great way to “lend” the software out without outright ownership privileges for customers. This helped keep upfront costs for customers to developing the software low. Companies like Salesforce and Concur were at the forefront of this movement and started providing business applications to businesses on a pay-per-use, which then evolved to a monthly subscription.

The rise of SaaS

For the last thirty years, we’ve seen an explosion of companies rely on software-as-a-service as the business model. Today, there are ~30,000 SaaS companies.

It’s become the de facto way of doing business and stopped being an innovation a while ago. In fact, as a founder you’d have to explain why your product wasn’t a SaaS product.

The SaaS model has been beneficial for both companies and its users:

Businesses are better able to predict their cashflow. Some businesses while charging a monthly fee, require an annual contract for that pricing which can help smooth out revenue predictions

Users have an easy and reliable way to receive that software. They know businesses are incentivized to continue to maintain and even innovate, because otherwise they would cancel the subscription and revenue would stall

Subscriptions are everywhere for consumers

This move towards the SaaS model has creeped into the consumer space, as product expectations and patterns jump from a person’s workplace to their home. We’re seeing a subscription model for groceries, haircare, mental health, fitness or nutrition.

The issue is that products have all become recurring subscriptions. We’ve also started to see the rise of prices as companies stop chasing growth in spite of low revenue. Ironically, the wider adoption of SaaS is what is killing further adoption of the model because of subscription fatigue.

“[Customers] got tired of paying for annual subscriptions that they didn’t utilize,” Andy Sealock, senior partner, advisory and transformation at consulting firm West Monroe

Let’s see an example of a consumer and all of their subscriptions

These are some daily common activities and the common products consumers use:

Wake up and see how good they’ve slept - WHOOP - $30 a month

Meditate in the morning - Calm - ($69.99 a year) - $5.8 a month

Exercise in the morning - $29.99 a month

Ryze coffee in the morning - $36 a month

Listen to music during work - Spotify - $11.99 a month

Watch some TV in the evening - Netflix - $15.49 a month

Watch some unique show you can only watch on Apple TV and HBO - $9.99 a month x 2

Look at photos on your phone - $2.99 a month

Journal in the evening - Day One - $2.49 a month

Guilty pleasure subscription - e.g. Cratejoy for consumer goods, Pourmore for whiskey subscription - $100 a month

Go to the gym in evening - $99 a month

This comes to a total of $353.73 a month of monthly subscriptions.

In fact, I’ve shared an example with 11 subscription and Statista found that the average consumer in the United States had 12 paid subscriptions.

It’s also quite common that consumers have multiple subscriptions in a single category. In fact, 49% of Americans pay for three streaming subscriptions a month.

Then we also see the constant price hikes. Let’s take streaming and music services as an example:

Netflix increased the pricing tier from $9.99 to $11.99 per month at the end of June 2024. Their last price increase was from $8.99 to $9.99 in January 2022, which corresponds to ~12.2% annual increase.

Spotify announced price increases from $10.99 to $11.99 in June 2024, a year after another $1 increase in July 2023, which resulted in an annual increase of ~9.5% over a two-year period.

Now, let’s add fixed costs and assume rent of $2,000 and car payments of $300 a month, and you can see that these recurring costs start representing a large cost that eat into your income.

The number of subscriptions a consumer has is out of control. Why spend more money on another recurring SaaS software as a consumer? With ~$350 a month of subscriptions, the value of the incremental value subscription needs to be that much higher.

With the continued verticalization and specialization of every single software product, companies charge for solving a single problem really well might just find a small niche and might need to accept they might never become a billion dollar company.

Consumers are just…less willing to pay for another niche subscription. I know I’m a lot more diligent about whether I need that additional subscription that helps me track my weight on an app rather than just put it in a spreadsheet and pay nothing for that.

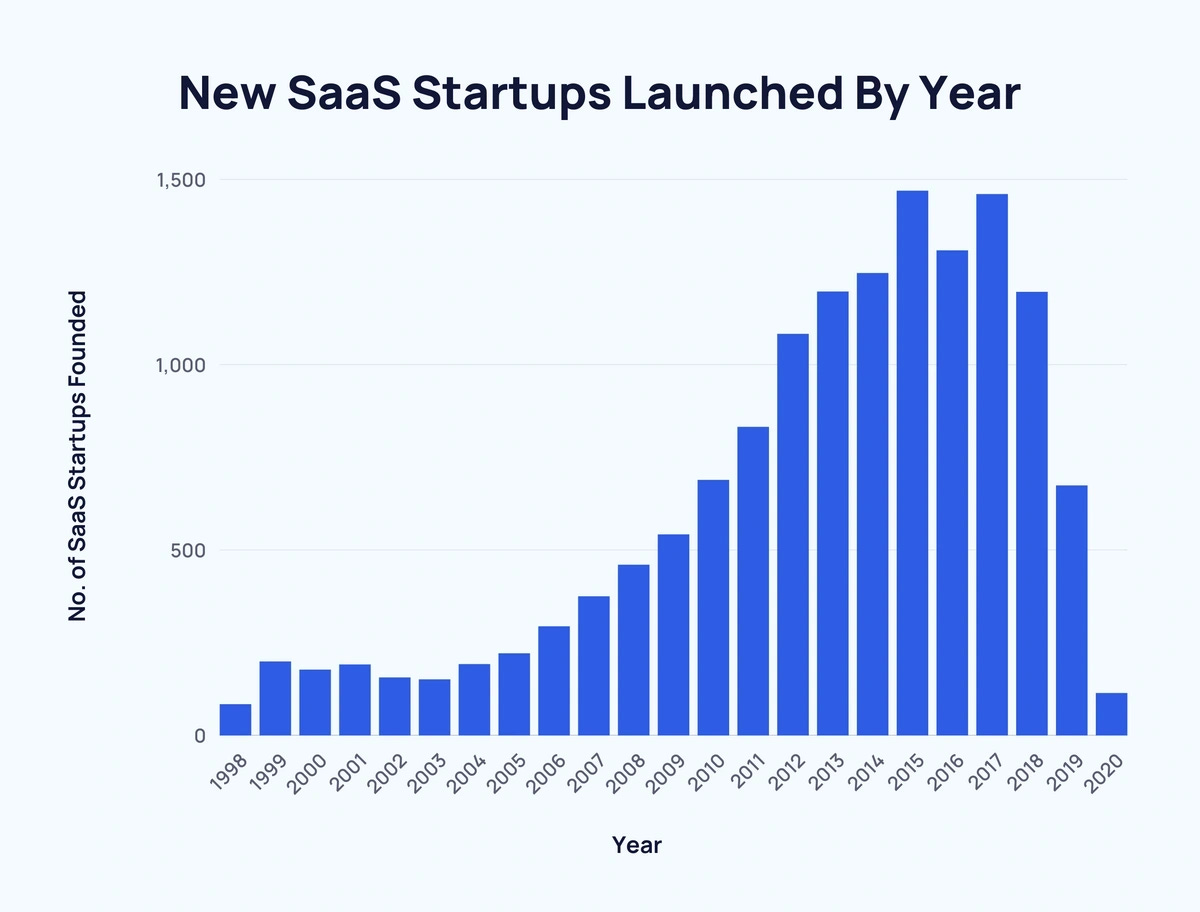

Growth rate of SaaS companies is slowing down

Because of the higher value that each SaaS product needs to provide, the creation of SaaS companies has started to taper off. While SaaS was a big opportunity in the past, there are now many more competitors for any specific consumer segment you might look at.

In addition, there’s also a movement away from SaaS overall. On-premise software is long gone, SaaS has its apex for the last ten years, and AI products are here to stay, ready to take over.

Increasing costs

The difficulty with AI-products are the rising costs. On top of a SaaS company'’s typical AWS bill, the unit cost is increasing because of tokens to use these foundational models. Tokens are a basic unit of measurement based on text that the model processes. A token can be a character or a full word. The word "critical" might be a single token, while a longer or less common word might be split into multiple tokens.

Many products wrap around a foundational model, ChatGPT or another, and each time the product is used, the company is charged for the input token. The unsustainable cost of AI-first SaaS products comes from the paradox that power users are costing a company much more than a normal user, whereas SaaS companies aren’t hit as hard by power usage.

We’ve seen how consumers are getting tired of SaaS pricing. But businesses might also be incentivized to change their pricing as well. So how might pricing change?

Hybrid usage-based pricing to price in costs

Hybrid business models that include usage-based pricing might increase. In fact, 3 out of 5 companies use usage-based pricing.

Here’s an example of a software company focused on providing consumers with nutritionist advice. You might have chat with Nutritionist AI for the basic tier, 1 nutritionist call a month for standard tier, and add-on calls with a nutritionist sold in packs of 5 that expire within 90 days. There’s a clear hybrid pricing model with subscription as a minimum limit of pricing and usage-based pricing for higher paying users.

The different pricing tiers are also the different steps of your sales funnel:

The lower cost, more generalized AI-nutritionist product nurtures early customers to try out and build confidence in the company’s product

The more expensive subscription is for a customer tier that needs something higher touch feedback and found value from the initial free product

The most expensive tier is a full-on experience with video nutritionist classes and where there’s a high intent to pay for the maximum value

In fact, A16Z highlights the three tiers as “Core”, “Upgrade” and “Add-on” in their recommended pricing tiers with GenAI.

Core includes AI products that are mission-critical to a company’s value proposition, Upgrade includes nice-to-have feature that can act as an upsell lever for the majority of customers and Add-on is for customers willing to pay a premium and where margins can be 80%+.

Depending on the investment that a client has in their health, they might upgrade or downgrade whenever they want, however the benefit is they can switch to what value they’re getting and the lifestyle they’re opting into. In one period of their life, they might have a life scare and decide the 5 additional nutritionist calls have an ROI in extending their life.

I believe we’ll see more mixed pricing models in the consumer space and that there are many more opportunities for experimentation.

Consumers are going to be pickier and will want to see a lot more value from any new product they purchase so the hardest part is getting your product discovered in a see of AI-companies focused on specific consumer niches.

If you’re building a business or products, what do you think might happen?